Sequin Blog

Debt

Your 2024 Financial Planning Checklist | 9 Steps to Take Today

November 20, 2023

We all felt the ups and downs — and financial volatility — of 2023. If you’re anything like us, you’re ready to arm yourself with a game plan to be more prepared in the new year.

But where to start?

A financial advisor can be a great partner, but unless you have a complex financial situation, you probably don’t need one.

For most of us, what we actually need is a game plan. A financial checklist of actionable steps to make sure we’re staying on track with our money goals.

There is an order to tackle your finances. And it’s simpler than you might think, once you understand the three pillars towards financial freedom.

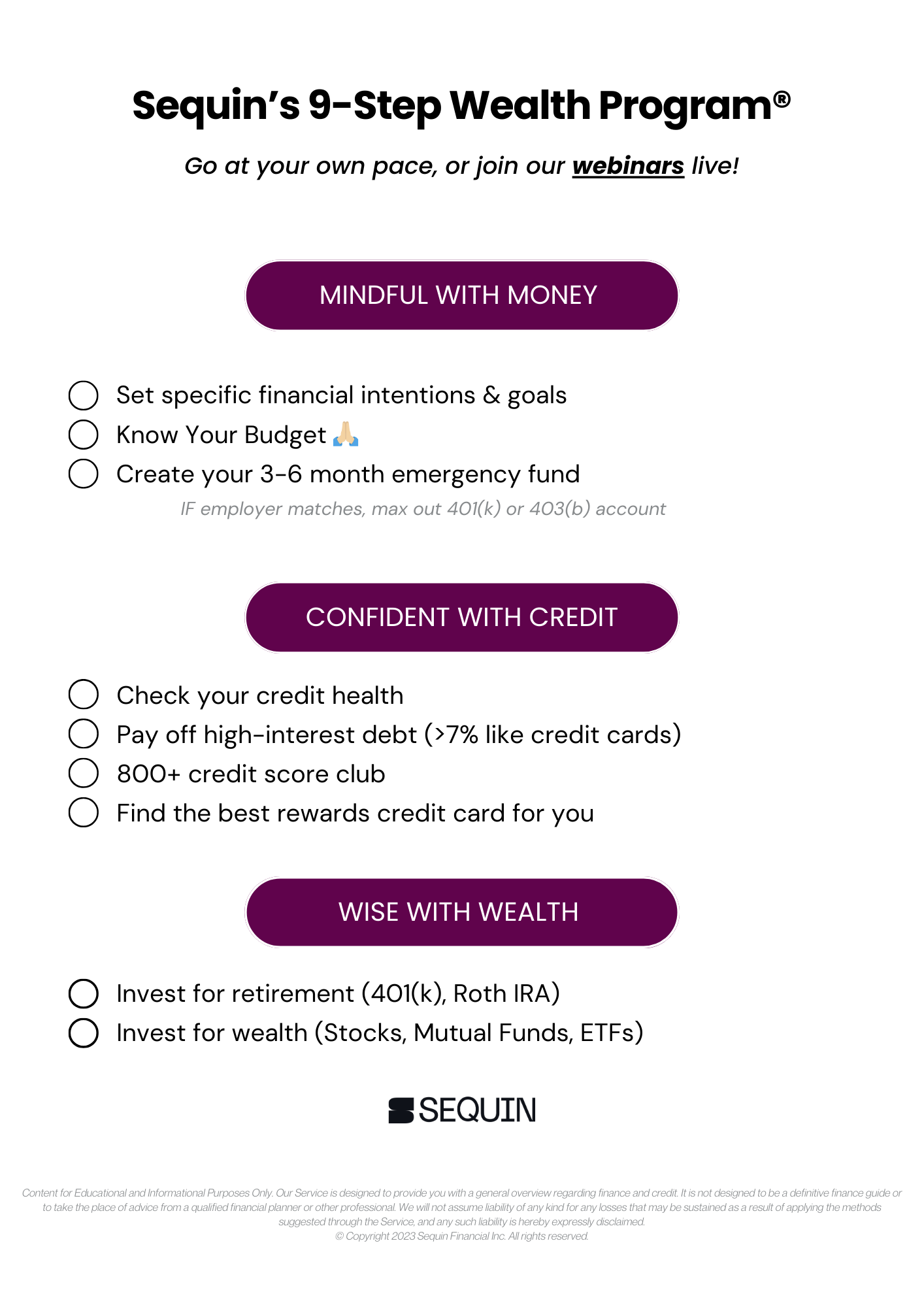

Becoming: Mindful with Money → Confident with Credit→ Wise with Wealth

Whether you’re assessing your financial situation, planning for the unexpected, or preparing for major life changes, let this checklist serve as your roadmap to a more empowered 2024.

Mindful With Money

1. Set Specific Financial Goals

Your next step is outlining your financial goals. We recommend picking two goals to focus on first. This keeps the overwhelm at bay.

Choose one short-term goal and one long-term goal.

Your short-term goal might include saving for a fabulous vacation, or that new custom couch you’ve been dreaming of.

Your long-term goals require you to think bigger. We typically say a long-term goal is one you’re looking to achieve in five (or more) years. This may be something like home ownership or saving for retirement.

Dream big, and then break those financial dreams into achievable, bite-sized goals.

Think goals like—

"I want to save $2,000 in 10 months to go to my friend’s wedding in Thailand." * "I want to be debt-free by the end of the year, which will set me up well to start investing."

"I want to start investing $100 into an index fund every month."

2. Know Your Budget

Creating a budget isn’t about restricting spending. It’s about aligning your spending with your values and goals—so you can intentionally direct your money to where it matters most.

Creating a budget isn’t about restricting spending. It’s about aligning your spending with your values and goals—so you can intentionally direct your money to where it matters most.

Understanding where your money goes each month allows you to make intentional choices that help move you toward your financial goals. Without that knowledge, you’re not in control of how you’re spending.

Action step for you → Pull out your favorite journal, your phone, or wherever you like to keep track of notes and tasks. Then write down all of your weekly purchases (yep, every single one of them).

What do you notice about how you’re spending? Classify each purchase by how it made you feel.

The more feel-good purchases you see, the more your spending is aligned with your goals. And the less likely you are to make impulse purchases that aren’t moving you toward them.

Then, categorize your monthly expenses into 50% needs, 30% wants, and 20% savings. This will give you an actionable framework to track your spending and create your budget.

3. Create Your Emergency Fund

Life’s an adventure! But it can also be unpredictable. To expertly navigate its twists and turns, you need a financial safety net.

Enter, the emergency fund.

Putting money each month towards an emergency fund gives you a financial cushion to handle any unforeseen expenses when life throws a surprise your way.

Calculate three to six months of expenses for emergency spending. Pull that number from your budget above, and get to saving.

It’s also important to make sure that money is growing for you in a high-interest account.

When choosing a high-interest account, make sure to keep an eye out for any transfer limits that may make your money less accessible. Choose the one that’s best for you and your needs, so you’re not put in a situation where you can’t access your funds when you need them.

Confidence with Credit

4. Check Your Credit Health

Understanding credit is your adult GPA—it’s used to determine your eligibility for most of your life goals. Whether that’s getting a house, car, or credit card rewards.

“Access to credit is access to opportunity.”—Vrinda Gupta, Sequin CEO & Co-Founder

Credit has two key parts—paying off high-interest debt, and growing your credit score using healthy credit habits.

We recommend checking your credit score monthly (or as often as weekly), as this determines your credit health—and is an essential part of keeping on track to meet your goals.

Sequin has your back with a free credit score and report so you can stay on top of where your credit score stands. Don’t worry, checking your credit report on your own won’t affect your credit score!

Getting comfortable checking your score is an important step in any healthy financial self-care routine.

For more actionable tips designed to help you improve your credit wellness, download your copy of our FREE Elevate Your Credit E-Book for a step-by-step guide.

5. Pay Off High-Interest Debt

When it comes to debt, you may be wondering where to start.

First, take stock of your debts. Write them all down and put the interest rate next to each one. Or use a tool like Sequin to automatically connect your credit cards and receive a personalized debt payoff or credit-building plan.

Next, take stock of your high-interest debt (anything above 7%) and plan to tackle this debt first. This will primarily be credit card debt. Mortgage debt, student loans, and car loans should be included in your financial plans as well. But are lower priority than high-interest debt.

Given the average stock market gains are 10% per year, and credit card interest rates average 27.8%, no amount of gains will outweigh high-interest credit card debt.

Tackling credit card debt first is a simple strategy that can do wonders for your credit score and save you loads in interest over time. In fact, just moving up from the “fair” to “very good” credit score range could save you a whopping $41,000.

Work to pay off this high-interest debt first. Then once you’re confident with credit you can move forward with investing and getting wise with wealth.

6. 800+ Credit Score Club

Savvy credit card usage can unlock benefits like travel rewards, perks, and lower-interest loans for cars, homes, and other life goals. But you have to make sure you’re making your credit work for you. Not the other way around.

Using your credit card strategically for planned expenses and necessary purchases helps you build credit without falling into the debt trap. For responsible credit management, make your payments on time, and keep your credit utilization below 30%.

Plus, paying off your credit cards every week versus just monthly has added benefits. This has resulted in a 20-point credit score increase on average in just one week.

For those of us who are credit card debt-free, there are still ways to optimize your credit score to get you to the 800+ club. For excellent credit, keep your credit utilization below 10% at all times.

7. Find the Best Rewards Card for Your Goals

From everything from cashback to travel perks, credit card rewards can help you get one step closer to your short-term financial goals and elevate the way you travel!

Almost every credit card offers some type of reward program. The key is understanding your card’s reward structure and using it to your advantage.

Find the best card for you by taking stock of which type of rewards program aligns best with your goals. That card will help you save the most valuable points and perks over time.

Wise with Wealth

8. Invest for Retirement with Tax-Advantaged Accounts

Becoming wise with wealth requires intention, and strategic investing to secure your financial future. Even though retirement may seem far away, it's important to take steps toward your retirement goals and invest your money.

To maximize your retirement savings it’s important to read up on the varying types of retirement accounts. Whether it be a 401K, Roth IRA, or Traditional IRA, each account comes with its own set of advantages.

For example, Roth IRA contributions are an awesome way to maximize your retirement savings. Your contributions are taxed when you contribute, allowing your wealth to grow tax-free.

For a 401(k) or 403(b) account, we recommend maxing out your contributions if your job offers employer matching.

Deciding which type of retirement account is right for you will depend on your individual financial goals. There are many tax-advantaged options when it comes to investing. Each account type has different tax advantages, and you’ll want to decide which is best for you.

9. Invest for Wealth

Strategic investing involves more than just choosing stocks. It’s about allocating your assets wisely to build wealth through compounding investments that will serve you well through your golden years.

Diversifying your investment portfolio helps to mitigate risk. You should aim for a different allocation of stocks and bonds based on your age and retirement goals. The more time you have until retirement, the higher your risk your allocation can be. As you get closer to retirement age, you’ll want to reallocate your investments to be less aggressive.

Time is the most important asset you have with investments and the power of compound interest. Actually taking the action to invest, is the second.

What we mean by this is to keep it simple. The most important thing is getting started so that you can reap the benefits of compound interest over time.

First, decide how you want to invest—individual stocks, ETFs, mutual funds, index funds—and then choose which account option is best for you. That could look like opening an individual brokerage account or opting to go with a robo-advisor.

Navigate Your Financial Journey with Confidence

You have the power to completely shift your finances in 2024. It all starts with a plan. Use this financial planning checklist as a roadmap to guide you. And get to checking off those boxes!

While a financial planner can be invaluable for complex scenarios, your financial future is ultimately in your hands.

For guidance, tools, and banking tailored to your needs, join the Sequin Women's Finance Club. Get the tools, resources, and guidance to crush your financial checklist in 2024!

Disclaimer:

Opinions expressed here are author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.